What You Need to Know About Financial Elder Fraud in 2019

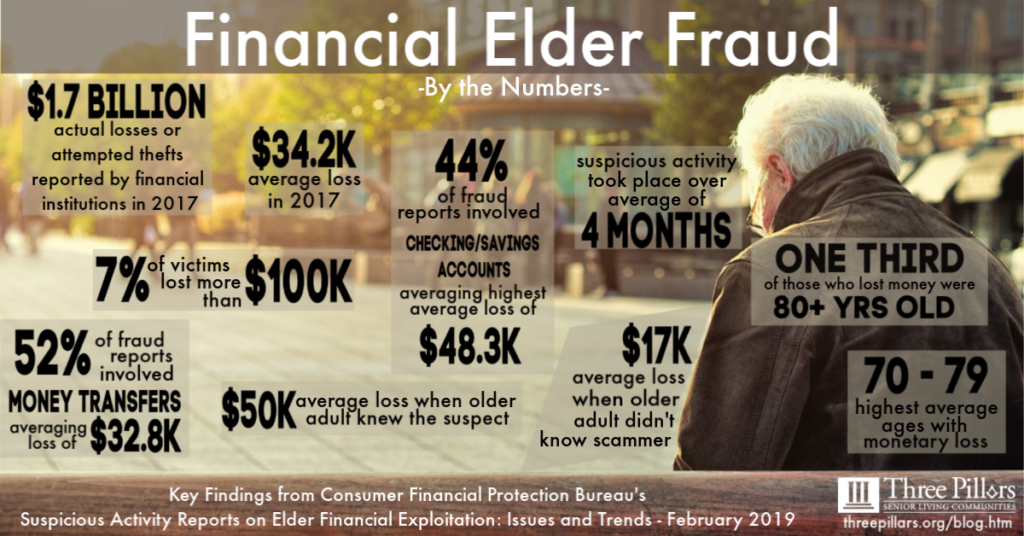

With reports of financial elder fraud on the rise, now is a critical time for older adults and their advocates to be aware, stay informed, and be proactive. New numbers in a February 2019 report by the federal Consumer Financial Protection Bureau (CFPB) show that reports of financial fraud against older adults have quadrupled since 2013, with 63,500 reports of suspicious activity filed in 2017.

Other key takeaways from the report show staggering statistics:

Perhaps the most unfortunate statistic of all is that this report likely only reflects, “a tiny fraction of elderly financial exploitation,” according the CFPB – likely because so many instances go un-reported. In a previous article we wrote about preventing senior scams, we outlined three of the top reasons older adults can be an “easy target,” according to the FBI. As a generation who was typically raised to be trusting and polite, seniors tend to be an attractive target and are seldom likely to report the fraud or feel confident in reporting what happened.

So what can we do?

The CFPB stated our need for “strong, diverse interventions,” to help prevent financial fraud against older adults, including involvement by financial institutions, law enforcement, and social services, as well as policymakers.

As an older adult or one who advocates for them, you can stay informed of current scams to be aware of, be alert to key indicators a scam, and be vocal in sharing with others who may otherwise be a target of fraud.

Here are the big three red flags for scams that should make you stop and think twice:

- Unsolicited approaches for money

Whether via email, letter, phone call, or text – a message that either promises or requests money shouldn’t be trusted. - Wiring funds

Be careful with any situation that involves wiring money, either from an account or a credit card. This irreversible process is a favorite for scammers since the funds are available to them almost instantly and it can’t be undone. - Threats or hyperbole

Financial scammers look for a way to tap into the victim’s fears, hopes, or generosity in order to get cash. If something sounds very bad or very good – like your granddaughter going to jail if you don’t wire the money immediately – think twice.

The opposite of scams executed by strangers are instances of financial fraud committed by someone close to the senior. Statistically speaking, the monetary loss is larger when the older adult knows the suspect.

You can be an advocate for yourself and others by paying attention to warning signs of financial elder fraud. Pay attention to:

- The disappearance or replacement of possessions

- Blank withdrawal slips in obvious places

- New acquaintances or previously uninvolved people showing a newfound affection or authority in someone’s life

Armed with knowledge, let’s combat financial elder fraud and drive the statistics down.

If you suspect you’ve been a victim or become aware of an instance of elder financial abuse, report it to:

- The Federal Trade Commission at www.ftc.gov/complaint or 877-FTC-HELP

and

- The Senate Special Committee on Aging at 855-303-9470 or www.aging.senate.gov/fraud-hotline